Applying is fast and easy

Complete your Sallie Mae® student loan application in 3 simple steps

- Tell us the basics

- Customize your loan

- Sign & go

Undergraduate loan rates

2.89%

to 17.49% APRfootnote 1

Fixed means your interest rate never changes.

If you want a predictable monthly payment, this is the way to go.

4.37%

to 16.99% APRfootnote 1

Variable interest rates go up or down as the market changes.

This means your monthly payments may also change—they might be higher if interest rates rise and lower if they fall.

Benefits you won't want to miss

No origination fees

There’s no fee to process a loan or if you pay it off early.footnote 2

3 repayment options

Go for what works best for your budget.

Consider a cosigner

Students with cosigners were 5x more likely to be approved last year.footnote 3

Save money

Get a 0.25 percentage point discount with auto debit.footnote 4

Up to 100% coverage

of school-certified costsfootnote 5—and you only need to apply once to get set for the whole year.

Of undergrad loans were cosigned

last year.footnote 6 A cosigner can be a guardian, relative, or friend.

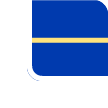

Breaking down your repayment options

Interest repayment option

How does it work?

You pay your interest every month you’re in school and in grace (the 6 months after).footnote 1

This is a great option if you want to save the most.

Freshman students may save 17% on their total loan cost by choosing interest repayment instead of deferred repayment.footnote 7

Keep in mind:

You might have higher monthly payments, but the total cost of your loan may be lower.

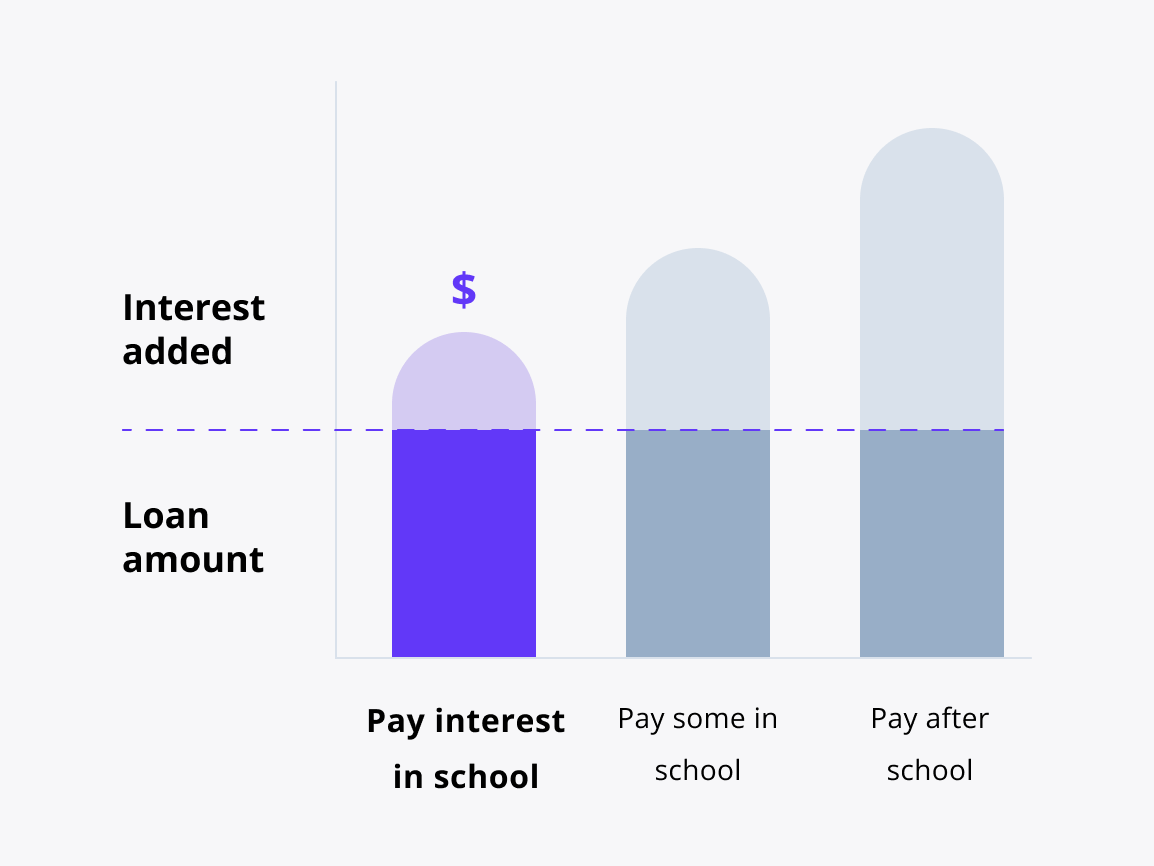

Fixed repayment option

How does it work?

You pay $25 every monthfootnote 8 you’re in school and in grace.footnote 1

This is a great option if you want to make a dent in payments from the start.

Freshman students may save 7% on their total loan cost by choosing fixed repayment instead of deferred repayment.footnote 7

Keep in mind:

Any interest you don't pay during school will be added to your principal amount (total borrowed) after grace.

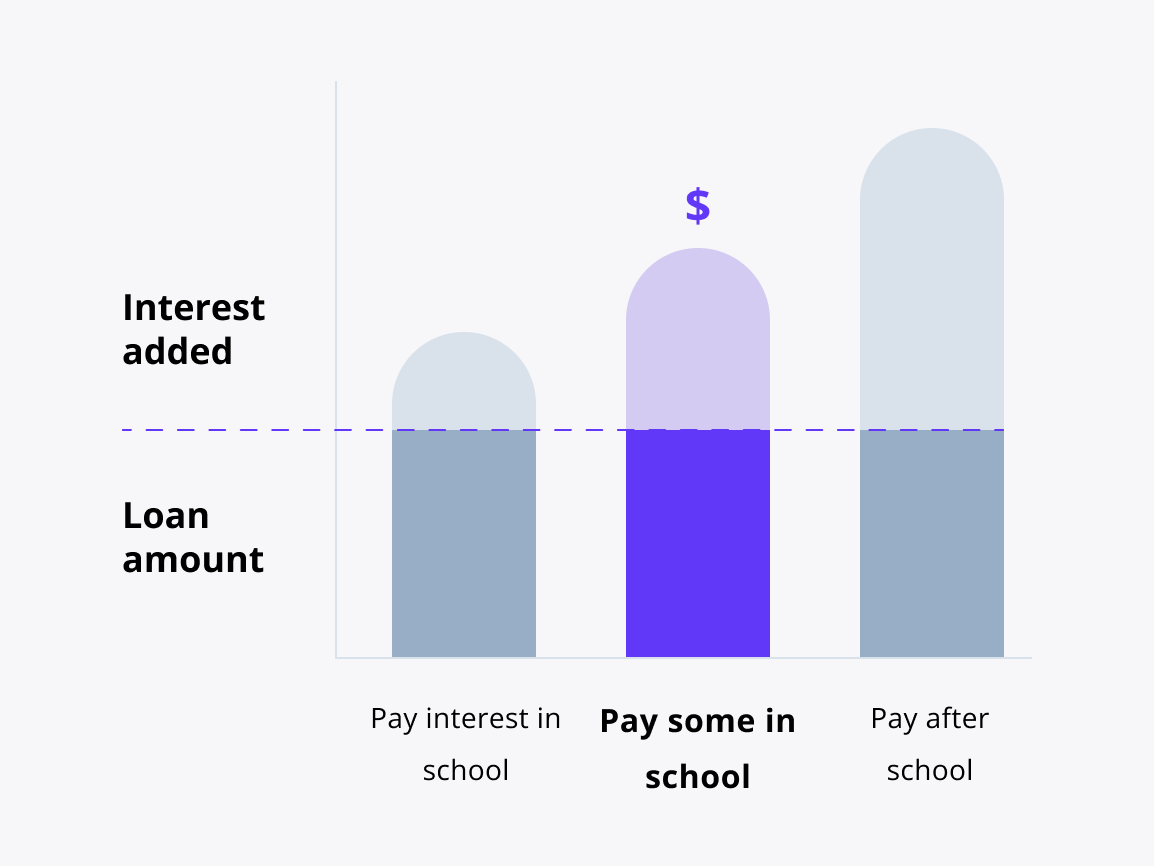

Deferred repayment option

How does it work?

You have no scheduled payments while you’re in school and in grace.footnote 1

This is a great option if you want to focus on class and not on making loan payments.

Keep in mind:

The total cost of your loan may be higher because the interest you don’t pay on your loan while you’re in school and grace will be added to the original amount you borrowed (principal amount).

minutes

1. Tell us some basics

2. Choose your loan options

3. Sign and accept

Let’s make sure you’re ready

You’ll need a few things to apply like address, Social Security number (if you have one), and details about your school.

FAQs

Questions? We’re here to help.

What is my school's cost of attendance?

You can estimate how much a whole year of school will cost using your school’s cost of attendance (COA), usually found on your financial aid offer or the school’s website.

The cost of attendance usually includes expenses like tuition, fees, books, meals, and transportation. Depending on the type of loan, your school may certify your loan amount. This means that your school confirms the loan amount to make sure you don’t borrow more than the cost of attendance.

Do I need a cosigner?

Most students don’t have the credit history to take out a loan by themselves. That’s where a cosigner can help. A cosigner is an adult with good credit who shares responsibility for the loan. By having a cosigner on the application, students’ chances of being approved may increase.

What’s the difference between a fixed and variable interest rate?

Fixed interest rate

The rate never changes, so you’ll have a predictable monthly payment amount.

Variable interest rate

The rate can go up or down as market conditions change. This means your student loan payments may also change—you might have lower payment amounts if interest rates fall and higher payments if interest rates rise.

What’s the difference between federal and private student loans?

Federal loans are provided by the government, while you take out a private loan from a bank like Sallie Mae, or a credit union. There are also differences in interest rates, repayment options, and other features.

When you apply for a private loan, the lender must check your credit, including your borrowing/repayment history, to decide if you qualify for a loan. Many federal loans don’t require a credit check