Fuel your passion with a health professions student loan

Pay for your expenses in allied health, nursing, pharmacy, and other graduate-level health degrees.

2.89%

to 14.99% APRfootnote 1

If you want a predictable monthly payment, this is the way to go.

3.75%

to 13.38% APRfootnote 1

This means your monthly payments may also change—they might be higher if interest rates rise and lower if they fall.

You’re training to make a difference, we’re here to help make it possible

Up to 100% coverage

of your school-certified costs like tuition, fees, housing, meals, travel, and more.footnote 4

Graduate borrowers were 2x more likely to get approved without a cosigner than undergraduates last year.footnote 5

Make 12 interest-only payments after your grace period.footnote 6

Months of deferment during your residency and fellowship.footnote 7

Month grace period to support you during your health career.footnote 8

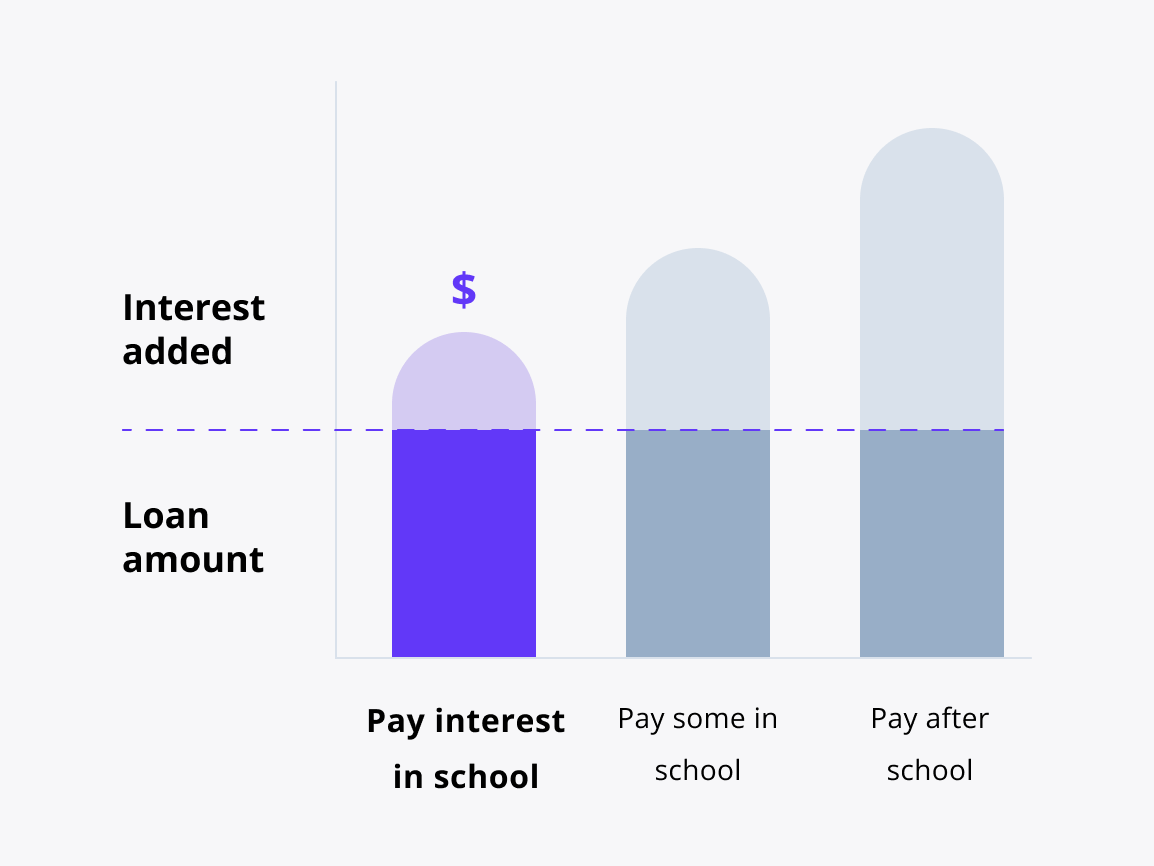

Breaking down your payment options

Interest repayment option

How does it work?

You pay your interest every month you’re in school and in grace (the 6 months after).footnote 1

This is a great option if you want to save the most.

Students may get an interest rate that is .50 percentage points lower than deferred repayment.footnote 1

Keep in mind:

You might have higher monthly payments, but the total cost of your loan may be lower.

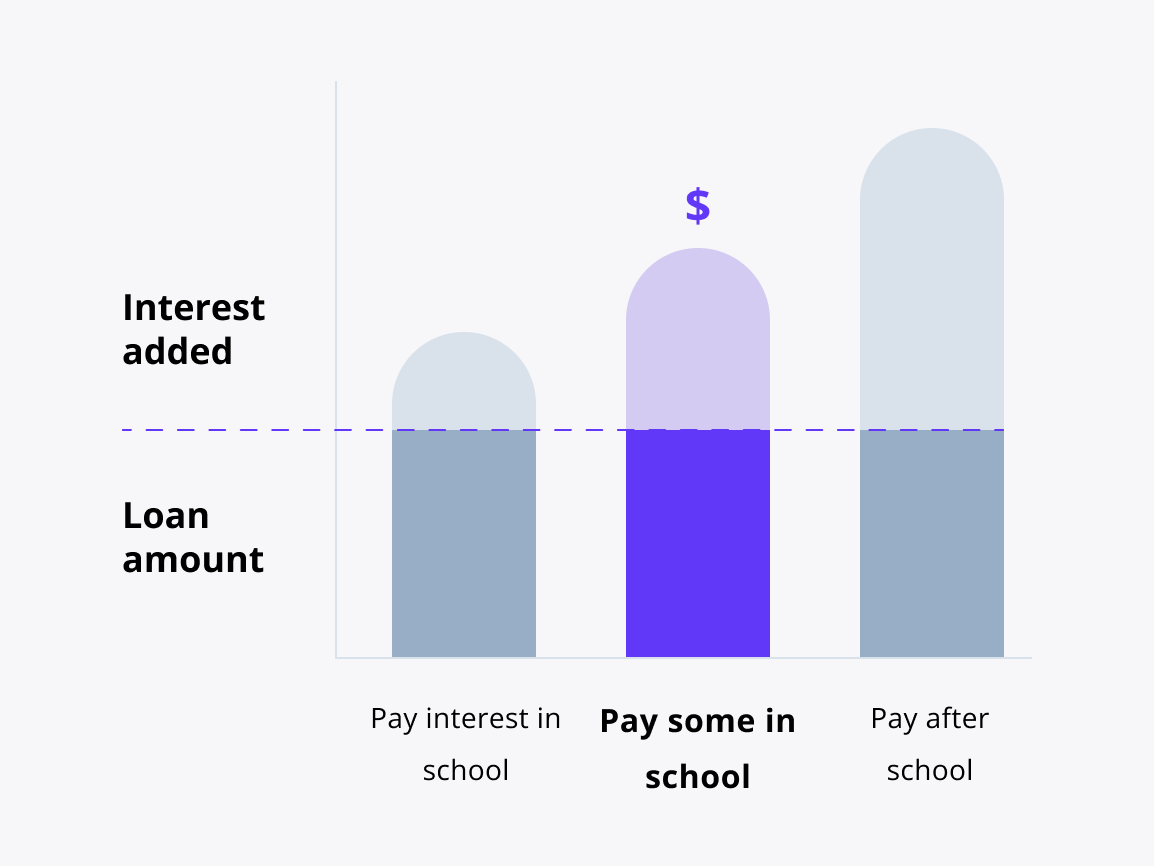

Fixed repayment option

How does it work?

You pay $25 every monthfootnote 9 you’re in school and in grace.footnote 1

This is a great option if you want to make a dent in payments from the start.

Students may get an interest rate that is .25 percentage points lower than deferred repayment.footnote 1

Keep in mind:

Any interest you don’t pay during school will be added to your principal amount (total borrowed) after grace.

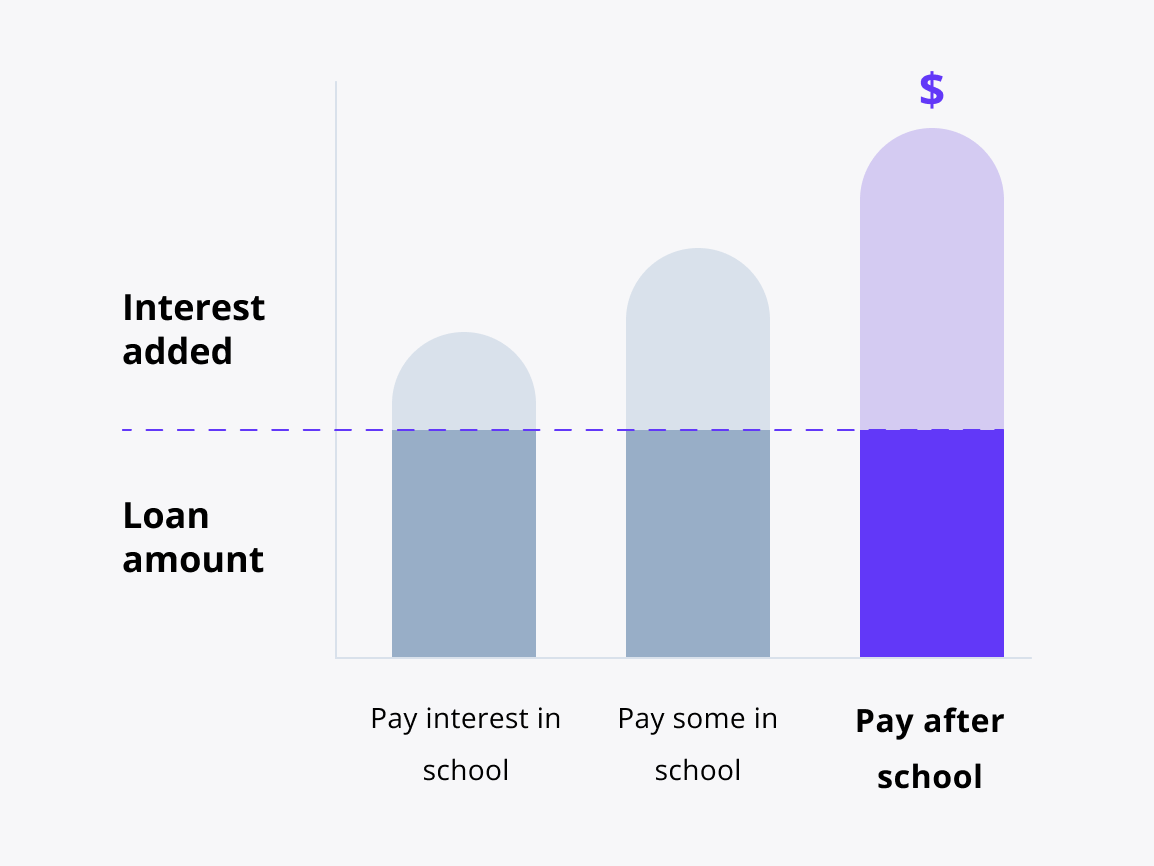

Deferred repayment option

How does it work?

You’ll have no scheduled payments while you’re in school and in grace.footnote 1

This is a great option if you want to focus on class and not on making loan payments.

Keep in mind:

The total cost of your loan may be higher because the interest you don’t pay on your loan while you’re in school and grace will be added to the original amount you borrowed (principal amount).

What you gain with our health professions loan

|

Sallie Mae® Graduate Health Professions Loan |

Other competitors |

|

|---|---|---|

|

Less than half-time enrollment eligibility |

|

|

|

Apply for cosigner release after 12 months of on-time principal and interest payments and when credit plus other eligibility requirements have been met.footnote 10 |

|

|

|

Interest-only payments for 12 months after grace period for qualifying graduate loan borrowersfootnote 6 |

|

|

|

Multiple repayment terms |

10 to 15-year termsfootnote 9 |

|

|

Cover up to 100% of the cost of attendance minus financial aidfootnote 4 |

|

|

|

Fixed and variable interest rate options |

|

|

|

In-school or deferred repayment options for graduate loan borrowersfootnote 1 |

|

|

minutes

1. Tell us some basics

2. Choose your loan options

3. Sign and accept

Let’s make sure you’re ready

You’ll need a few things to apply like address, Social Security number (if you have one), and details about your school.

FAQs

Have other questions? We’re here to help.

833-613-8158