Level up your career with a graduate student loan

Let us secure your financial needs while working toward your master’s or doctoral degree.

3.19%

to 14.99% APRfootnote 1

Fixed means your interest rate never changes.

If you want a predictable monthly payment, this is the way to go.

4.37%

to 13.98% APRfootnote 1

Variable interest rates go up or down as the market changes.

This means your monthly payments may also change—they might be higher if interest rates rise and lower if they fall.

Graduate school loan benefits

Up to 100% coverage

of your school-certified costs like tuition, fees, housing, meals, travel, and more.footnote 4

Graduate borrowers were 2x more likely to get approved without a cosigner than undergraduates last year.footnote 5

Make 12 interest-only payments after your grace period.footnote 6

Months of deferment during your residency and fellowship.footnote 7

Month grace period to support you during your career.footnote 8

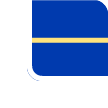

Breaking down your repayment options

Interest repayment option

How does it work?

You pay your interest every month you’re in school and in grace (the 6 months after).footnote 1

This is a great option if you want to save the most.

Students may get an interest rate that is .50 percentage points lower than deferred repayment.footnote 1

Keep in mind:

You might have higher monthly payments, but the total cost of your loan may be lower.

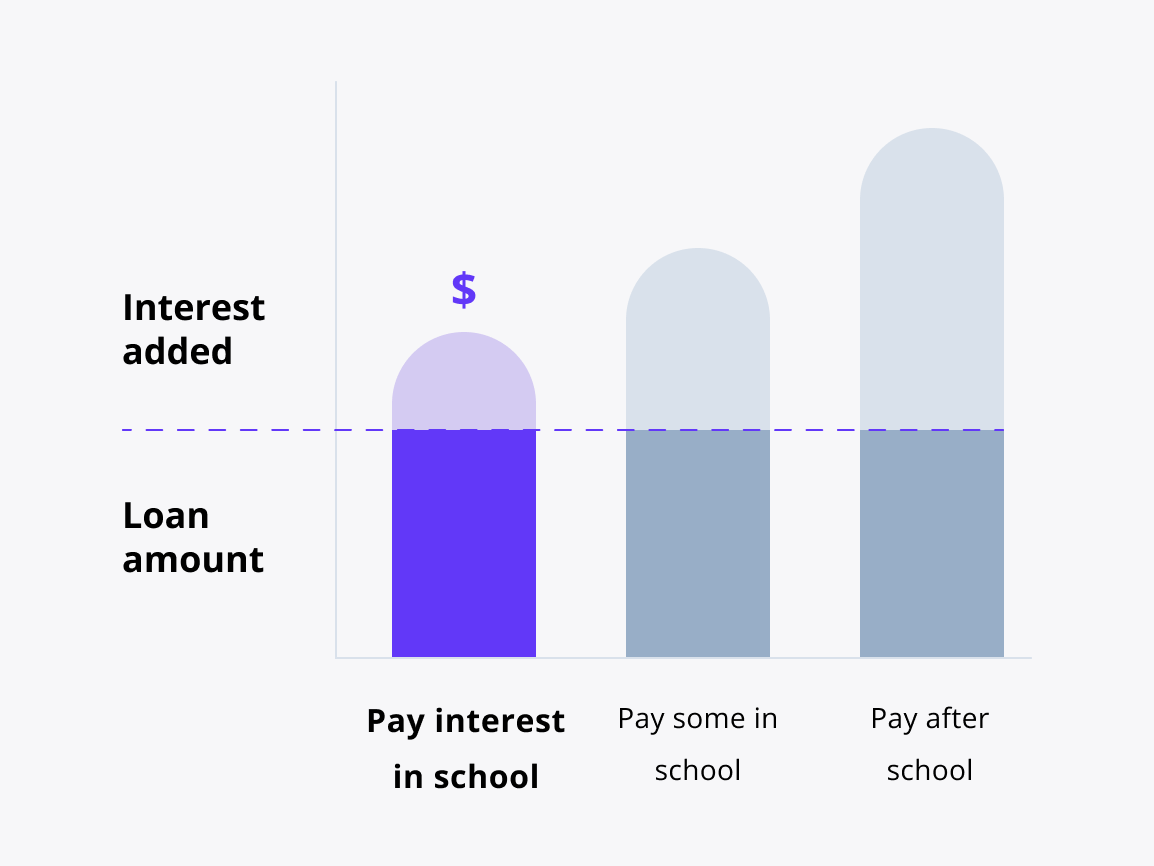

Fixed repayment option

How does it work?

You pay $25 every monthfootnote 9 you’re in school and in grace.footnote 1

This is a great option if you want to make a dent in payments from the start.

Students may get an interest rate that is .25 percentage points lower than deferred repayment.footnote 1

Keep in mind:

Any interest you don’t pay during school will be added to your principal amount (total borrowed) after grace.

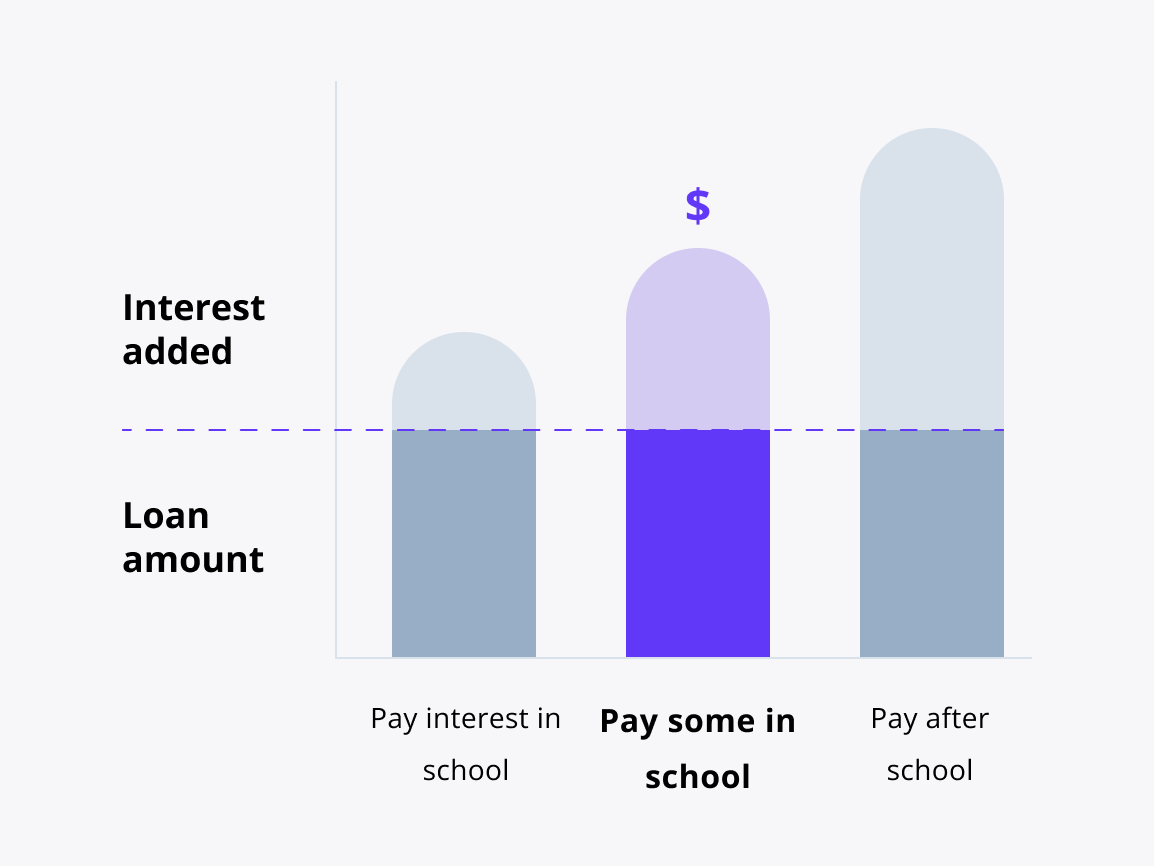

Deferred repayment option

How does it work?

You’ll have no scheduled payments while you’re in school and in grace.footnote 1

This is a great option if you want to focus on class and not on making loan payments.

Keep in mind:

The total cost of your loan may be higher because the interest you don’t pay on your loan while you’re in school and grace will be added to the original amount you borrowed (principal amount).

What you gain with our graduate school loan

|

Sallie Mae® Graduate School Loan |

Other competitors |

|

|---|---|---|

|

Less than half-time enrollment eligibility |

|

|

|

Apply for cosigner release after 12 months of on-time principal and interest payments and when credit plus other eligibility requirements have been met.footnote 10 |

|

|

|

Interest-only payments for 12 months after grace period for qualifying graduate loan borrowersfootnote 6 |

|

|

|

Multiple repayment terms |

10 to 15-year termsfootnote 9 |

|

|

Cover up to 100% of the cost of attendance minus financial aidfootnote 4 |

|

|

|

Fixed and variable interest rate options |

|

|

|

In-school or deferred repayment options for graduate loan borrowersfootnote 1 |

|

|

minutes

1. Tell us some basics

2. Choose your loan options

3. Sign and accept

Let's make sure you're ready

You’ll need a few things to apply like address, Social Security number (if you have one), and details about your school.

FAQs

Have other questions? We’re here to help.

1-877-279-7172

Which student loans are available for graduate students?

Grad students can apply for federal and private loans. Federal loans are funded by the federal government, and you apply for Federal Direct Unsubsidized Loans by filling out a FAFSA®. Private student loans are offered by banks and credit unions, and you apply directly with the lender. Sallie Mae offers private student loans for graduate school.

Depending on the professional field that you're planning to enter, you may have different needs for a graduate school loan. For example, medical and dental degrees often require residencies, so it can help to have a deferment period. That’s why we offer graduate student loans designed for specific degrees: medical school, dental school, law school, MBA, and health professions graduate school. We also have a Graduate School Loan for humanities, sciences, and other degrees.

Learn more about the differences between federal and private student loans for graduate students.footnote 11

How do I apply for a private graduate school loan?

It's easy to apply for a graduate school loan. Use the “Apply now” button on this page to start. You’ll be asked a few questions to decide which graduate loan is right for you. Then, you'll fill out some basic information about you and your studies. The process usually only takes around 10 minutes.

How much can I borrow as a graduate student?

The amount that you can borrow for graduate school generally depends on the loan. Most of our graduate school loans let you borrow from $1,000 up to 100% of the school-certified Cost of Attendance (COA).footnote 4 The COA is an estimate of what you'll pay for expenses like tuition and fees, room and board, books and supplies, travel to and from school, a laptop or other technology, and personal expenses. You’ll most likely find it in your financial aid award letter or on your school’s website.

What are the benefits of applying for a graduate school loan?

The greatest benefit to taking out a graduate school loan is being able to pay for the graduate education that's important to you. Most grad students see the expense of getting a degree as an investment in their future. Many believe that it can help them enter or advance in their chosen career field, and potentially reward them with higher earnings.

What kind of interest rates does Sallie Mae offer for graduate school loans?

Sallie Mae Graduate School Loans have two types of interest rates you can choose from: a fixed rate and a variable rate.

The rate never changes, so you’ll have a predictable monthly payment amount.

The rate can go up or down as market conditions change. This means your student loan payments may also change—you might have lower payment amounts if interest rates fall and higher payments if interest rates rise.

Can I use a graduate school loan to pay for any college-related expenses?

You can get up to 100% of your school fees covered each year you’re in school with a Sallie Mae Graduate School Loan, including the following for students attending school at least half time.footnote 4

What you can use graduate loans for

- Tuition

- Fees

- Books and supplies

- Housing

- Meals

- Transportation

- Technology and equipment

- Childcare expenses

- Other expenses as long as they are included in your school's cost of attendance

What you can’t use graduate loans for

- Nonessentials (new clothes, concert tickets, etc.)

- Dining out and entertainment

- Other debts (credit cards, car note, etc.)

- Travel for vacations

Check out this blog for what you can and can’t use student loans for

Can I apply for a graduate school loan if I already have existing student loan debt?

If you have existing student loan debt, you can still apply for a graduate school loan. After you apply and undergo a credit review, Sallie Mae will determine whether you are eligible for another student loan. But always borrow smart—only take out loans that you know you can afford to pay back with interest.

Can international students apply for graduate school loans?

Yes! International students can apply for graduate school loans. Students who are not U.S. citizens or permanent residents who reside in and attend school in the U.S. are eligible with a creditworthy cosigner (who must be a U.S. citizen or U.S. permanent resident) and an unexpired government-issued photo ID to verify identity.

Although international students are not eligible for federal student loans through the Free Application for Federal Student Aid (FAFSA®), there is still financial aid, grants, and scholarships available to them.